Green finance contributes to building greener Belt and Road

Aerial photo shows a Fuxing bullet train running through Nanxihe grand bridge on the China-Laos Railway in southwest China's Yunnan Province, June 2, 2022.

Amidst the increasingly imperative global demand for green and lower-carbon economy, China carried further green finance together with the Belt and Road countries and regions to pool efforts in building a green Silk Road.

Green finance refers to financial services provided to fund economic activities in support of environmental improvement, climate change and highly efficient utilization of resources. It is helping channel capital into green infrastructure, green energy, green transportation and other green sectors in countries jointly building the Belt and Road.

-- Progressing towards greener Belt and Road

Since June 2016 when China proposed to build the green Silk Road, the country kept improving its green finance policies regime and developing the green finance market, which played an increasingly important role in supporting the green and sustainable development of Belt and Road countries and regions.

By providing financing in form of loans, equity and debt investment to green Belt and Road projects, Chinese financial institutions stood as a strong supporter for greening the Belt and Road.

A cases study on Belt and Road renewable energy projects released by the International Institute of Green Finance (IIGF) under the Central University of Finance and Economics (CUFE) showed that the proportion of fossil energy in all energy investment and projects invested by Chinese institutions in the Belt and Road countries and regions decreased since the year of 2016 and fell to the lowest level in 2020.

The proportion of their renewable energy investment and construction projects in their overall Belt and Road energy investment rose to 58 percent in 2020, outrunning that of fossil energy for the first time, and no investment was made in coal-related Belt and Road projects by Chinese compnies in 2021 and first half of 2022.

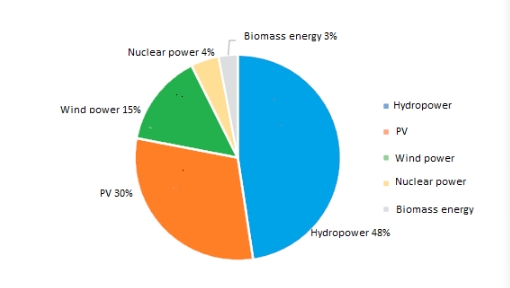

Chart I: Belt and Road green energy projects invested and built by Chinese companies during 2021 and 2022 H1

Source: IIGF of CUFE based on public data and data from AEI

Meanwhile, issuing green bonds in China also serves as an option for institutions from the Belt and Road countries and regions and global financial institutions to fund their green Belt and Road projects.

Hungary, one of the earliest countries that signed Belt and Road Initiative (BRI) cooperation documents with China, raised two billion yuan via green panda bonds issuance on November 16 with Bank of China (BOC) as the lead underwriter and bookkeeper.

As BOC said, proceeds of the green panda bonds would be used to support qualified green expenditures on multiple fields so as to promote Hungary's transition to an economic mode featuring low-carbon, climate adaptation-oriented and environmentally sustainable development.

Apart from these, Chinese financial institutions also kept innovating green financial services to better build the green Silk Road. By leveraging more innovative products and services such as carbon neutrality bonds, publicly-offered transition bonds, biodiversity-themed green bonds, green financial leasing, etc., Chinese financial institutions vigorously practiced the green development philosophy and presented to the world their determination and acts to build greener Belt and Road.

-- International co-op mechanisms with greater influences

On spurring green and low-carbon development of the Belt and Road countries and regions, international green finance cooperation mechanisms that China initiated or participated in are exerting constructive influences.

For instance, the Green Investment Principles for the Belt and Road (GIP) released by the Green Finance Committee of China Society for Finance and Banking and the City of London's Green Finance Initiative in November 2018 have become a typical platform of fostering green finance development in Belt and Road countries and regions.

Covering three aspects, namely the strategy, operation and innovation, GIP include seven principles including embedding sustainability into corporate governance, thoroughly disclosing environmental information, utilizing green financial instruments, adopting green supply chain management and building capacity through collective action to encourage voluntary adaptation and implementation by the Belt and Road investors.

Over the past four years since its releasing, GIP has received positive responses from international financial community with related principles gradually put into practice in a widening scale.

By mid-September 2022, GIP saw signatories up to 44 ones, including financial institutions from developed economies such as the UK, France, Germany, and Japan and developing nations such as Pakistan, Kazakhstan, and Mongolia as well. Moreover, there were 14 supporting institutions from 17 countries and regions. The signatories and supporters altogether held or managed assets of more than 41 trillion U.S. dollars.

Another important pillar for China and BRI partners to shore up green finance development is the Green Development Guidance for BRI projects (GDG) launched by the Belt and Road Initiative International Green Development Coalition (BRIGC) in 2019. It focuses on influences of Belt and Road projects on environment pollution, biodiversity protection and climate changes.

In the past years, positive and negative lists under the GDG have been preliminarily proposed and application manuals for enterprises and financial institutions and a green development guide for the railway and highway infrastructure sectors as well have also been compiled to provide green solutions to the Belt and Road countries and regions.

-- Green finance capacity building in full swing

As a vital means to invigorate green finance development in Belt and Road countries and regions, capacity building for developing green finance has always been leveraged by China to share Chinese wisdom with countries jointly building the Belt and Road.

For example, the China-IMF Capacity Development Center (CICDC), a collaborative venture between the People's Bank of China (PBOC) and IMF aiming to help build strong economic institutions and foster human capacity development in IMF's core areas of expertise in China and in countries associated with the BRI has provided training for at least 1,200 officials from the Belt and Road countries and regions and contributed to improving the soft environment for financing under the BRI.

Meanwhile, the Chinese central bank also sought actively third-party capacity building cooperation with multilateral development institutions in Belt and Road countries and regions, which served as beneficial explorations to complement their related advantages.

Multiple forms of green finance capacity building have also been offered by Chinese financial institutions to green investment in the Belt and Road.

Currently, the Belt and Road Bankers Roundtable initiated by Industrial and Commercial Bank of China has been an important cooperation and capacity building platform for commercial financial institutions in Belt and Road countries and regions. China Development Bank, the Export-Import Bank of China, Agricultural Bank of China, and BOC provided lots of training related to the sustainable development of the Belt and Road.

Think tanks also made their contributions. The Center for Green Finance Research of National Institute of Financial Research under Tsinghua University facilitated countries such as Mongolia, Kazakhstan and Pakistan to formulate green finance standards and develop green project environmental benefits appraisal vehicles. It also established a green finance capacity building program with International Finance Corporation, etc. and hosted many symposiums for countries in central Asia, Latin America and Africa.

Editor:黄鑫